are dental implants tax deductible in 2019

Are Dental Implants Payments Tax Deductible. You can only deduct expenses greater than 75 of your income.

Dental Implant Cost Dental Implants Start From 900

Your dentist would not implant them unless they were a medicaldental necessity even if the procedure was elective.

. Single 12200 1650 65 or older. Ad Are You Missing Teeth. From 29 with 12 month plan.

Call ClearChoice a Trusted Industry Leader. Dental implant patients have three ways to utilize IRS-sanctioned programs to generate significant discounts. Birmingham Al Auto.

It would be great if these procedures were all tax deductible but this is not always the case. Medical expenses are an itemized deduction on Schedule A and are deductible to the extent they exceed 10 of your adjusted gross income AGI. For instance if you had 3000 in dental expenses and made 20000 1500 of your expenses are deductible.

If you were reimbursed or if expenses were paid out of a Health Savings Account or an Archer Medical Savings Account. If you are 65 or over they are deductible to the extent they. There is a small catch though.

To enter your medical expenses go to FederalDeductions and CreditsMedicalMedical Expenses. Lets say you make 40K a year. You may deduct only the amount of your total medical expenses that exceed 7.

Citizens or resident aliens for the entire tax year for which theyre inquiring. Cutting your costs by 22 to 39 could make a massive impact on your ability to afford to replace those missing teeth. Citizen or resident alien for the entire tax year.

The agency also makes it a point to note that purely cosmetic procedures and personal use items are not tax-deductible. This includes fees paid to dentists for X-rays fillings braces extractions dentures etc. The second factor involves your adjusted gross income.

May 3 2021 By Staff. 22 2022 published 512 am. Are full moth dental implants tax deductible on Schedule A.

May 31 2019 855 PM. There is a small catch though. Get your Free At-Home Impression Kit Today.

When you itemize the IRS allows you to deduct medical and dental expenses that exceed 75 percent of your adjusted gross income for tax year 2021. The refundable medical expense supplement is a refundable tax credit available to working individuals with low incomes and high medical expenses who meet the income requirement and all of the following conditions. 502 Medical and Dental Expenses.

If married the spouse must also have been a US. You can include in medical expenses the amounts you pay for dental treatment. Are Dental Implants Tax Deductible 2021.

Taxes on your gross income are deductible by 5. Use the information outlined in this article to develop an action plan in consultation with your. Cover Missing Teeth Gaps and Spaces with Custom Removable Veneers.

Dental implants are considered a medical expenses. If youre wondering whether cosmetic surgery dental implants LASIK or other medical expenses are tax deductible the IRS has a document for you. Of course your medical expenses plus your other itemized deductions still have to exceed your standard deduction before you will see a difference in your tax due or refund.

Fl Capital Gains Tax Rate 2021 August 7 2022. 2019 - Answered by a verified Tax Professional We use cookies to give you the best possible experience on our website. A lot of people find that getting a dental implant is one of the best things that they can do for themselves.

Yes if they are not merely cosmetic and the dentist has recommended them as treatment for your dental condition. Dental expenses can be a big part of an individuals or a familys medical expensesDental procedures such as root canals fillings and repairs and braces can run into the hundreds and even thousands of dollars. Your 2019 Guide to Tax Deductions - The Motley Fool Before 2018 older people could deduct medical expenses that exceeded 10 of.

If you itemize your deductions for a taxable year on Schedule A Form 1040 Itemized Deductions you may be able to deduct expenses you paid that year for medical and dental care for yourself your spouse and your dependents. So that means its not possible to deduct the cost of in-home or in-office teeth whitening. Yes if they are not merely cosmetic and the dentist has recommended them as treatment for your dental condition.

Yes dental implants are an approved medical expense that can be deducted on your return. You made a claim for medical expenses on line 33200 of your tax return or for the disability supports deduction on line 21500. Remember though that your itemized deductions for medical dental expenses are reduced by 75 of your Adjusted Gross Income AGI and that total itemized deductions includi.

So fully deductible if exceed 10 agi in 2019. Citizens or resident aliens for the entire tax year for which theyre inquiring. This is specifically mentioned so that helps if it ever came to an audit.

Liberty Tax And Loans Idaho Falls August 7 2022. Expenses related to OTC toothpaste dental floss mouthwash and general care products are typically not considered tax-deductible. By continuing to use this site you consent to the use of cookies on your device as described in our cookie policy unless you have disabled them.

Santa Barbara Sales Tax Rate 2019 August 7 2022. You would have to eat the first 3000 of those expenses before it starts lowering your tax obligation. Are Dental Implants Tax Deductible In 2019.

22 2022 Published 512 am. The tool is designed for taxpayers who were US. The good news is that will include all of your medical and dental expenses not just your dental implants.

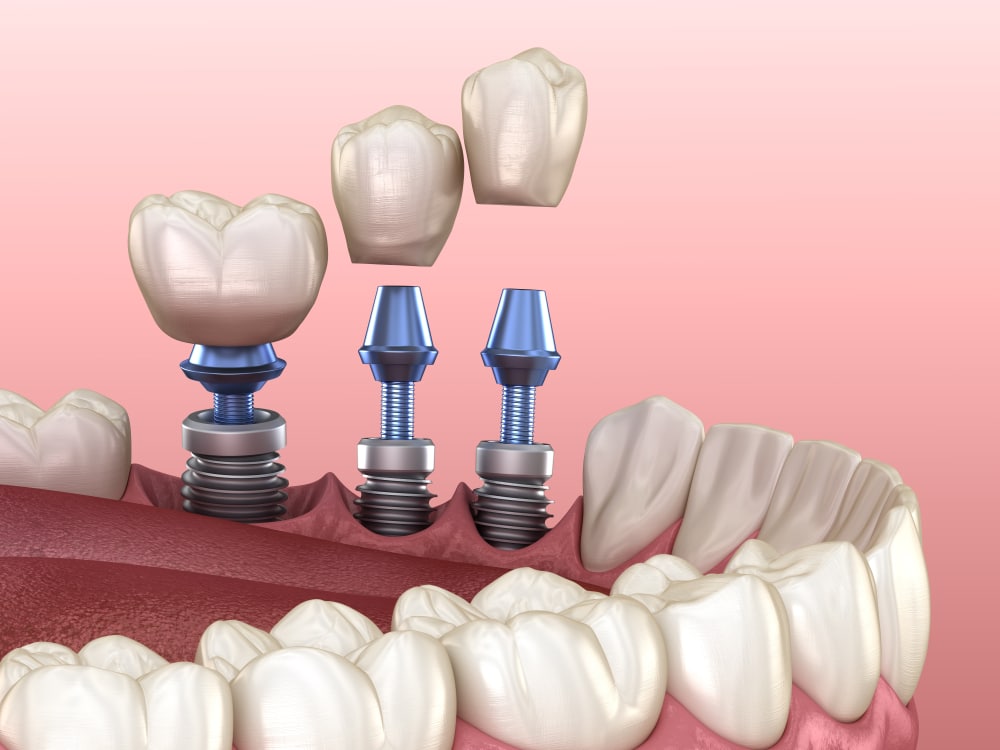

Dental Implants Surgery In Ottawa Argyle Associates

Dental Implants Ident Dental Vaughan Dentistry 905 553 2647

Dental Implants Vs Dentures What S Right For You

Dental Implant Cost Costa Mesa How Much Does Single Tooth Implant Cost In Orange County Dentistry At Its Finest

Are Dental Veneers And Implants Tax Deductible

Dentrix Tip Tuesdays Processing Payments Promptly By Adding A Credit Card To A Payment Agreement Payment Agreement Dental Office Management Credit Card

How To Pay For Dental Implants Implant Financing Options European Denture Center

Which Dental Expenses Are Considered Deductible Medical Expenses When Filing Income Taxes 2022 Turbotax Canada Tips

How Do Child Support Offsets Affect Tax Refunds And Stimulus Checks Spending Problem Supportive Child Support Payments

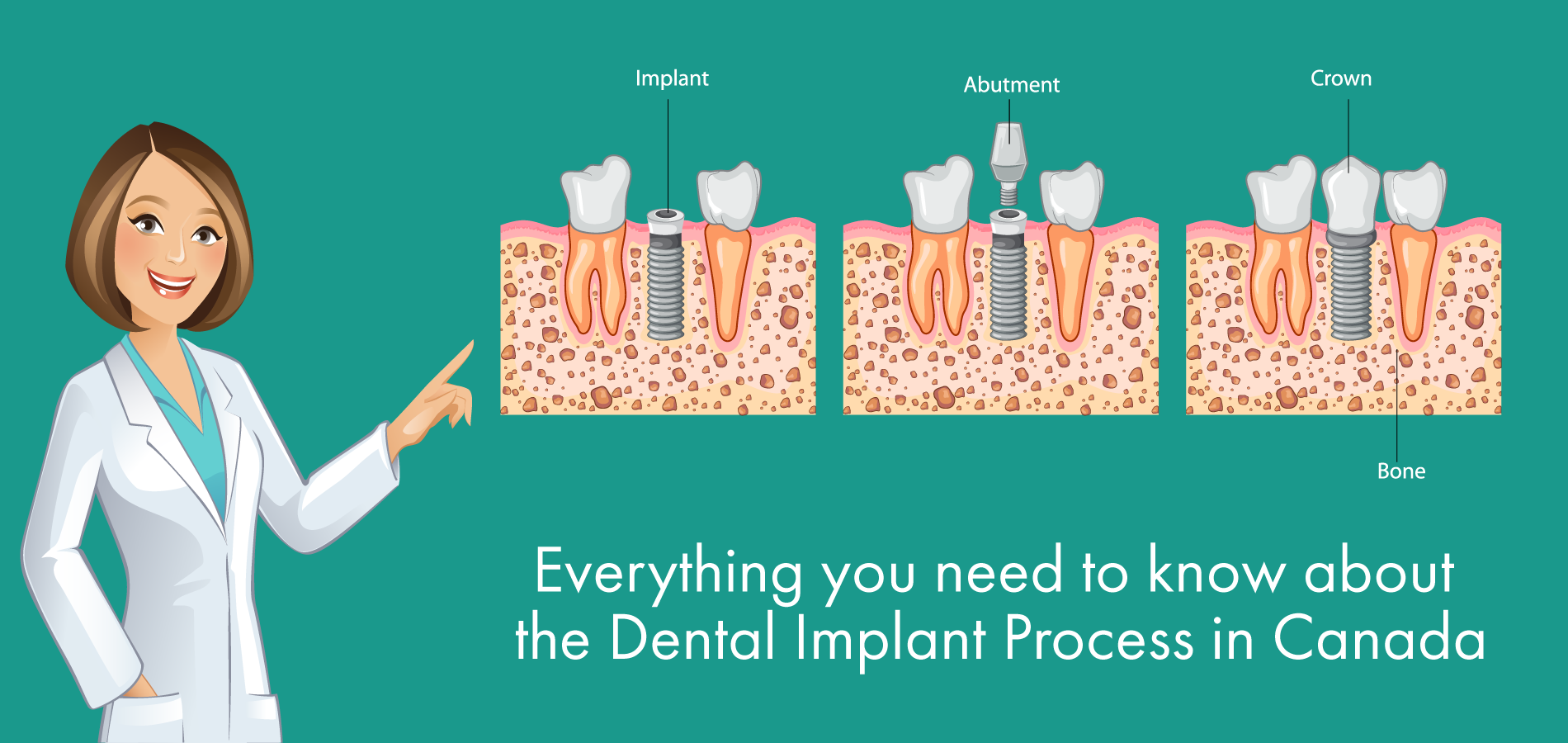

Everything You Need To Know About The Dental Implant Process In Canada

Are Dental Implants Tax Deductible Drake Wallace Dentistry

5 Things You Need To Know About Gift Cards Gift Card Cards Gifts

How To Get Cheapest Dental Implants In The World Prices Under 500

Dentrix Tip Tuesdays Automatically Creating Secondary Insurance Claims Dental Insurance Dental Insurance Plans Insurance

The Truth About Dental Insurance And Invisalign In Toronto Inform Yourself To Receive Maximum Benefits

Dental Implants Ident Dental Vaughan Dentistry 905 553 2647

Dentrix Tip Tuesdays Options When Generating The Aging Report Dental Office Management Resume Aging