schedule c tax form h&r block

HR Block Online Federal Forms Tax Year 2021. Old HR Block tax software versions for 1998 1999 2000 2002.

HR Block has been approved by the California Tax Education Council to offer The HR Block Income Tax Course CTEC 1040-QE-2355 which fulfills the 60-hour qualifying education requirement imposed by the State of California to become a tax preparer.

/ScreenShot2021-02-07at3.03.39PM-69096f457ec344ce9ca4bb158a195baa.png)

. If a loss you. Go to line 32 31 32. Self-employment income of 400 or more.

H R Block at 40 Jersey Ave New Brunswick NJ 08901. Residential Rental Property Including Rental of Vacation Homes at wwwirsgov. HR Block suggests Schedule C I know I need Form 1120-H federal form but am not sure which form for State.

Form W-3 for sending Copy A of Forms W-2 to the Social Security Adminis-tration SSA. HR BLOCK at 125 Avon Ave Newark NJ 07108. Form 1041 line 3.

Returns and Allowances include cash or credit refunds you make to customers or price reductions on productsservices. If you are the sole proprietor of a business or have single-member LLC youll fill out this form when you do your taxes each year. HR Block tax software and online prices are ultimately determined at the time of print or e-file.

If you have a loss check the box that describes your investment in this activity. Expires January 31 2021. Your gross salesreceipts goes on Line 1Give the dollar amount for all productsservices you sold.

CTEC 1040-QE-2355 2020 HRB Tax Group Inc. HR Block Online Federal Forms Tax Year 2021. The form is titled Profit or Loss from Business Sole Proprietorship.

CTEC 1040-QE-2355 2020 HRB Tax Group Inc. Ad Edit Sign or Email IRS 1040 SC More Fillable Forms Register and Subscribe Now. HR BLOCK at 139 Washington Ave Belleville NJ 07109.

Form 1040 Schedule 3 Additional Credits and Payments Form 1040-ES Estimated Tax Form 1040-V Payment Voucher Form 1040X Amended US. File a 1040 Schedule C to the IRS online. If you receive these types of income or losses you may need to file a 1040 tax form.

Fill out the Schedule C and Schedule SE Forms. Income you receive as one of these. Shareholder in an S corporation.

Federal is 7495 and state is an additional 1995. Schedule C is a tax form for small business owners who are either a sole proprietor or have a single-member LLC. Form 1040 Individual Income Tax Return Form 1040-SR Individual Income Tax Return for Seniors.

Ad Edit Sign Print Fill Online more fillable forms Subscribe Now. QuickBooks Self-Employed lets you classify incomes and expenses using categories that align with the IRS Schedule C Form. Schedule C in some cases To learn more see Publication 527.

I was told by H R Block I needed Schedule C but the President of the Association thinks that is wrong. QuickBooks Payroll 2022 Cost. If you checked the box on line 1 see the line 31 instructions.

If you checked 32a enter the loss on both. Ad File your 1040 with a Schedule C for free. Schedule SE line 2.

Expires January 31 2021. HR Block has been approved by the California Tax Education Council to offer The HR Block Income Tax Course CTEC 1040-QE-2355 which fulfills the 60-hour qualifying education requirement imposed by the State of California to become a tax preparer. Subtract the total of your returns and allowances from your total sales for the year.

Cost of goods sold. All prices are subject to change without notice. Cut 2005 Business with Business State download for as many states as you need included.

This package is not for Schedule C Businesses or. You can also save on HR Block and TaxAct. Federal filing is always free for everyone.

Beneficiary of an estate or trust. Schedule H 100 2020 783120 3 I J - I I 7 TAXABLE YEAR 2020 Dividend Income Deduction CALIFORNIA SCHEDULE H 100 Attach to Form 100. Schedule C Profit or Loss from Business Expenses Schedule D Capital Gains and Losses Schedule E Rents Royalties Partnerships Etc.

Once you have put together your tax deduction list fill out the Schedule C and Schedule SE forms with all of your expenses. Expires January 31 2021. QuickBooks is the 1 payroll provider for small businesses and they claim that customers save an average of 84 every time they run payroll.

Partner in a partnership. CTEC 1040-QE-2355 2020 HRB Tax Group Inc. In addition to having all standard personal tax forms this includes Schedule C and SE for sole proprietors self-employed.

Individual Income Tax Return Form 1095-A. Plus HR Block costs significantly less for those filing as self-employed. HR Block has been approved by the California Tax Education Council to offer The HR Block Income Tax Course CTEC 1040-QE-2355 which fulfills the 60-hour qualifying education requirement imposed by the State of California to become a tax preparer.

Insurance policy dividends that are more than the premiums you paid. Fast easy free federal filing for everyone. Schedule 1 Form 1040 line 3 and on.

What Is A Schedule C Tax Form H R Block Ad Download Or Email Form B6H More Fillable Forms Register and Subscribe Now.

Organizing Your Personal Documents Http Www Apersonalorganizer Com Personal Document C Documents Organization Paper Organization Paper Clutter Organization

Tax Information Center Irs H R Block

Tax Information Center Irs H R Block

Tax Information Center Irs H R Block

Tax Information Center Irs H R Block

Did You Know Your Tax Liabilities Will Be Different Depending On Your Business Structure You Need To Kno Business Checklist Business Structure Business Basics

Filing A Schedule C For An Llc H R Block

California Tax Forms H R Block

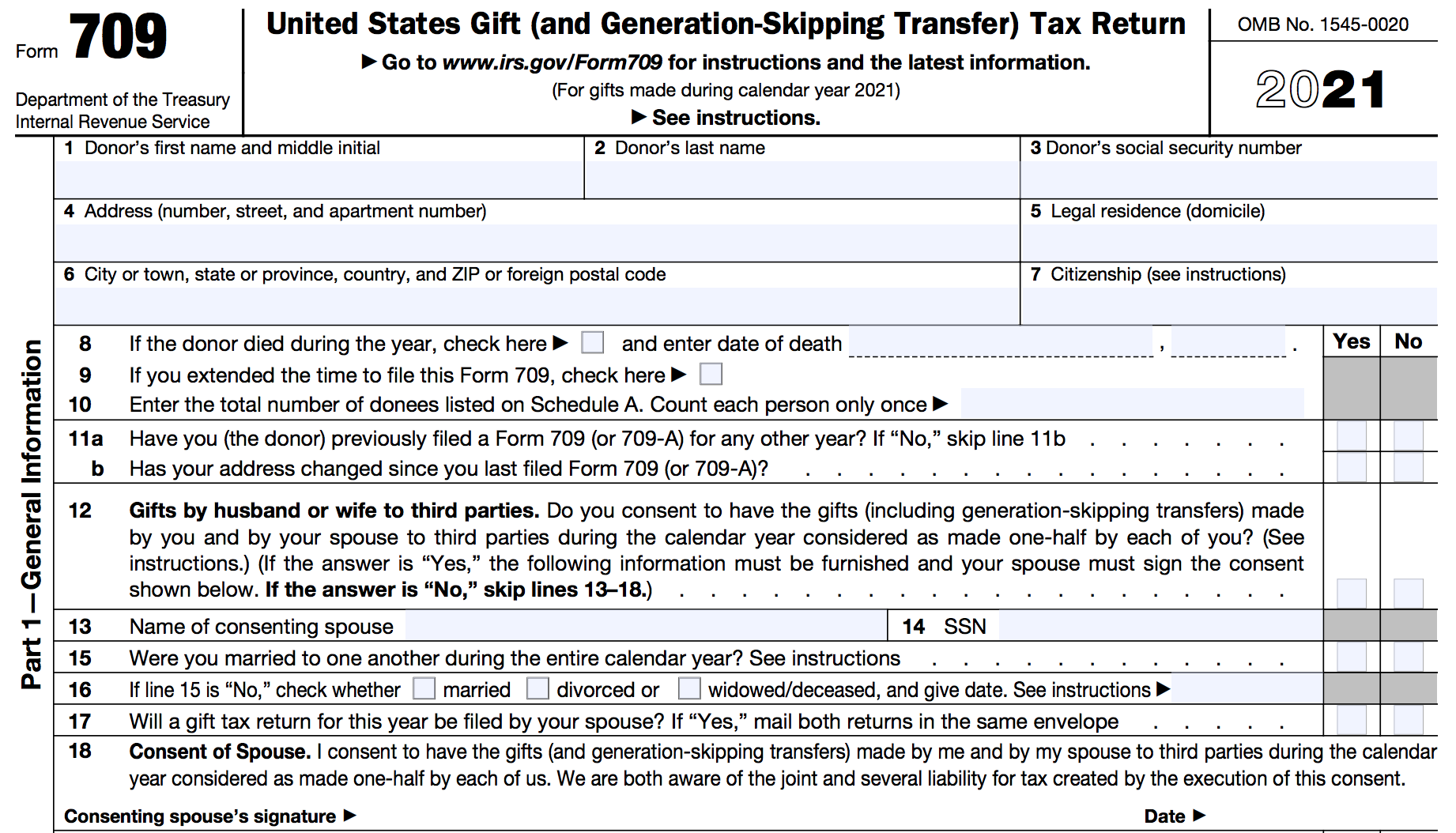

How To Fill Out Form 709 Step By Step Guide To Report Gift Tax Smartasset

Understanding The 1065 Form Scalefactor

/ScreenShot2021-02-07at3.03.39PM-69096f457ec344ce9ca4bb158a195baa.png)

When Would I Have To Fill Out A Schedule D Irs Form

So You Missed The Tax Filing Deadline Now What Top Stories Wxow Com